Last 25 July we went live with the event ‘Beauty Brand: the trick to cut IT costs and act instantly on every touchpoint’.

During the webinar, Pierpaolo Bironi, Head of E-Commerce at Pettenon Cosmetics, talked about the Group’s digitisation journey (find the case study here).

Pettenon Cosmetics Brand Portal by THRON

In addition to his valuable testimony, the meeting was an opportunity for us to rationalise the information gathered from industry experts and our cosmetics customers.

In this article, we look at them together, with a glimpse of the main data and digital challenges ahead of 2025.

Definitely good.

The national association of cosmetics companies estimates that by the end of 2024, the sector will exceed EUR 16.6 billion, close to +10% compared to 2023, which in turn marked +13%.

The turnover of Italian cosmetics companies rises. Source: I numeri della cosmetica, Cosmetica Italia, 2024.

A market in which exports play a decisive role, accounting for almost 50% of the total turnover of our companies. The countries most devoted to Italian beauty include the USA, France and Germany, but also the UK, Poland, the Emirates and China.

Growth is driven, in particular, by natural, green and organic products, which in the last survey (2023) posted +32% compared to the previous year.

In absolute values, it is the large-scale retail trade where most cosmetics and personal care products are purchased; in 2023, the mass market alone generated more than forty per cent of the total sector turnover.

In relative terms, however, it is other channels that are growing the most; physical, such as perfumeries and herbalist shops – up 14.2 per cent and 12 per cent respectively – but also online. E-commerce, in fact, marked +12.5% and, according to projections, will mark a new double-digit increase (+10.1%) at the end of the year.

E-commerce is among the beauty touchpoints that have grown the most in 2023. Source: I numeri della cosmetica, Cosmetica Italia, 2024.

For the near future, therefore, all eyes will be on the relationship with B2B partners and the performance of online shops. And it is also with this awareness that we now face the challenges of beauty brands for 2025.

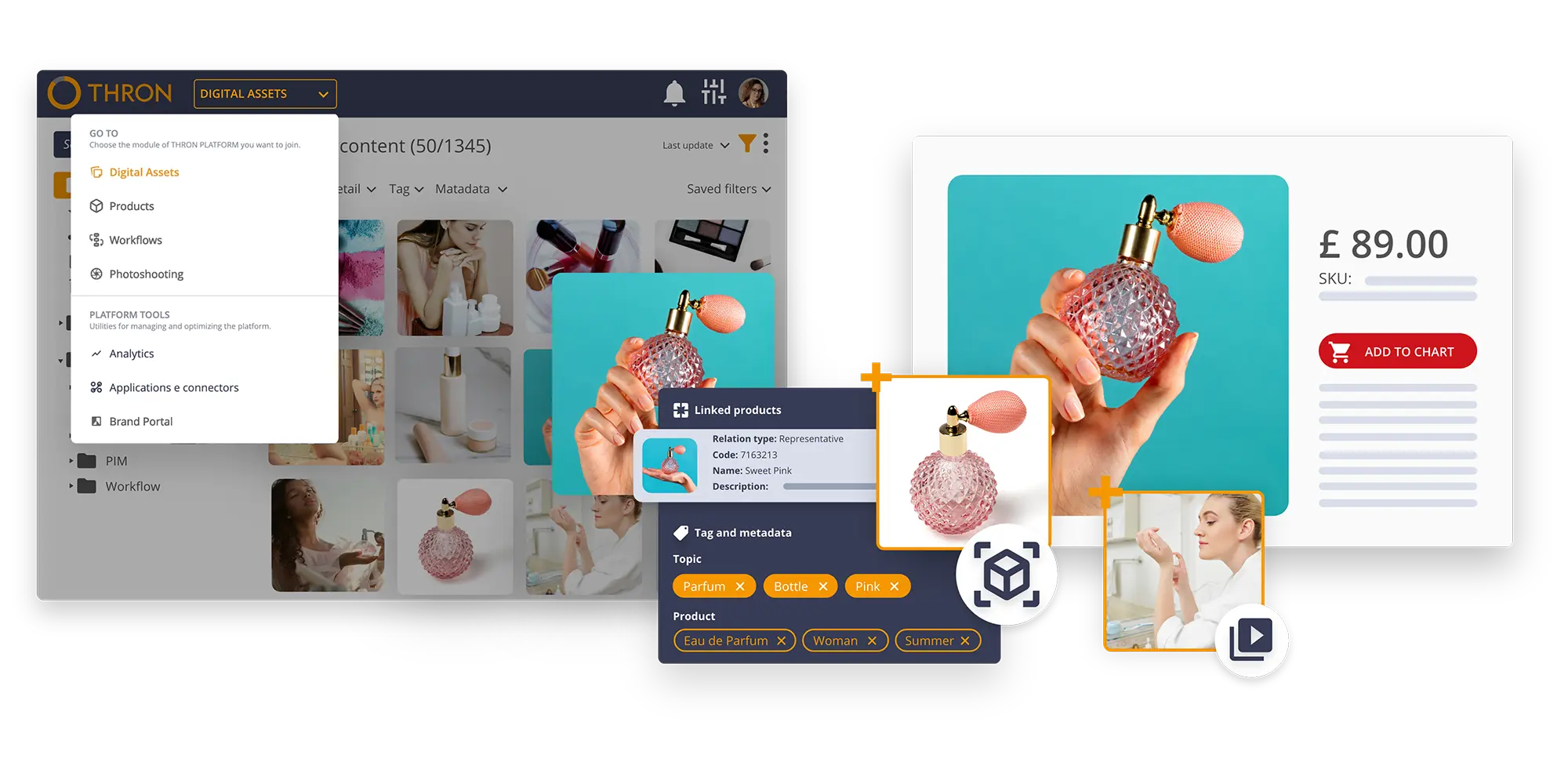

Over the past few months, we have been talking to some of the leading cosmetics manufacturers who have chosen THRON PLATFORM to analyse with them and respond to the challenges posed by the market in the present and immediate future and which can be overcome through a structured Digital Asset Management and Product Information Management approach.

Here are the main ones.

The proliferation of content and communication channels in recent years has led to a progressive fragmentation of knowledge because most companies, swept up in the digital wave, were not ready to manage the company’s information assets for the brand sales network, B2B partners and B2C customers.

Hence the agility of activities such as searching, updating, approving, delivering digital assets and product information is no longer an option.

The still life shots of a package and the emotional video clip of a campaign are not the only essential elements for communicating and promoting a beauty assortment.

The data and information of an article are also essential. Firstly, to guide the user’s choice. Secondly, for legal issues.

One example for all is the INCI, an acronym that stands for International Nomenclature of Cosmetic Ingredients, which consists of the obligation to list the ingredients it contains on the product packaging.

Beauty companies offer the market a wide range of products, whose information – not only on chemical compositions but also on certifications and copyrights – must converge in a safe, accessible space that is in constant dialogue with the company’s business goals, in order to avoid misalignments that could lead to legal damage.

Often companies in the sector are veritable Groups that, exploiting economies of scale, attack market segments with different products and brands.

A scenario in which the fragmentation of multimedia content and business-critical data finds fertile ground, fuelled by teams working with different logics and dynamics within repositories that differ in structure and taxonomy.

Contexts in which timeliness becomes utopia, as well as overview, risking jeopardising the timely launch of campaigns or the launch of new products and, ultimately, the profitability of such initiatives.

The world of influencers has been in fermentation in recent months.

Although it is reasonable to consider it subject to consistent evolution – perhaps increasingly skewed towards micro-communities – it is equally unlikely that the role of Brand Ambassadors and the like will cease to exist.

Figures such as testimonials, regardless of the number of followers, need immediate and real-time access to up-to-date information and content, whether brand or product.

An issue that with the increasing emergence of micro- and mid-tier influencers will become more and more central, resulting in the need to share specific information and assets in a timely manner depending on the audience segment these figures address.

Closely linked to the two previous points, multi-target strategies are the lowest common denominator for cosmetics companies and amplify the volume of complexity to be managed in terms of media content and product data.

In a nutshell, just think of the abysmal differences between the B2C and B2B markets.

Depending on whether the positioning takes the form of websites, e-commerce or single-brand sales outlets – in the former case – or with distributors such as herbalists, pharmacies and large-scale retail chains, the governance of the information assets is crucial. Only with it is it possible to deliver to each interlocutor and touchpoint the perfect image, template, video in terms of version, format, quality and any other attribute.

We close this set of challenges for 2025 for the world of cosmetics by allowing ourselves to evolve one of the most famous statements in marketing. It was the year one thousand nine hundred and ninety-six when Bill Gates called content ‘king’.

Almost three decades later, this is still the case, as long as the content also performs.

Phenomena such as the war of attention, rising expectations in terms of user experiences of users as well as the need to respond to short-lived, high-intensity seasonal events (such as sales, Black Friday, and so on) have made it clear that content is no longer enough if it is not also timely and usable at peak performance.

Here again, the governance of digital assets and product information – complemented by the delivery of content and its AI-driven dynamic optimisation – enable beauty and cosmetics brands to deliver superb, instantaneous web (and phygital) performance, regardless of the timing and workload of teams.

If you have read this far, you might like to go further.

From the testimony collected during our webinar, we made a summary clip and summarised the main KPIs of the MarTech stack digitisation project at Pettenon Cosmetics.

We wouldn’t miss it if we were you 😉